Casual Tips About How To Apply For Vat Number

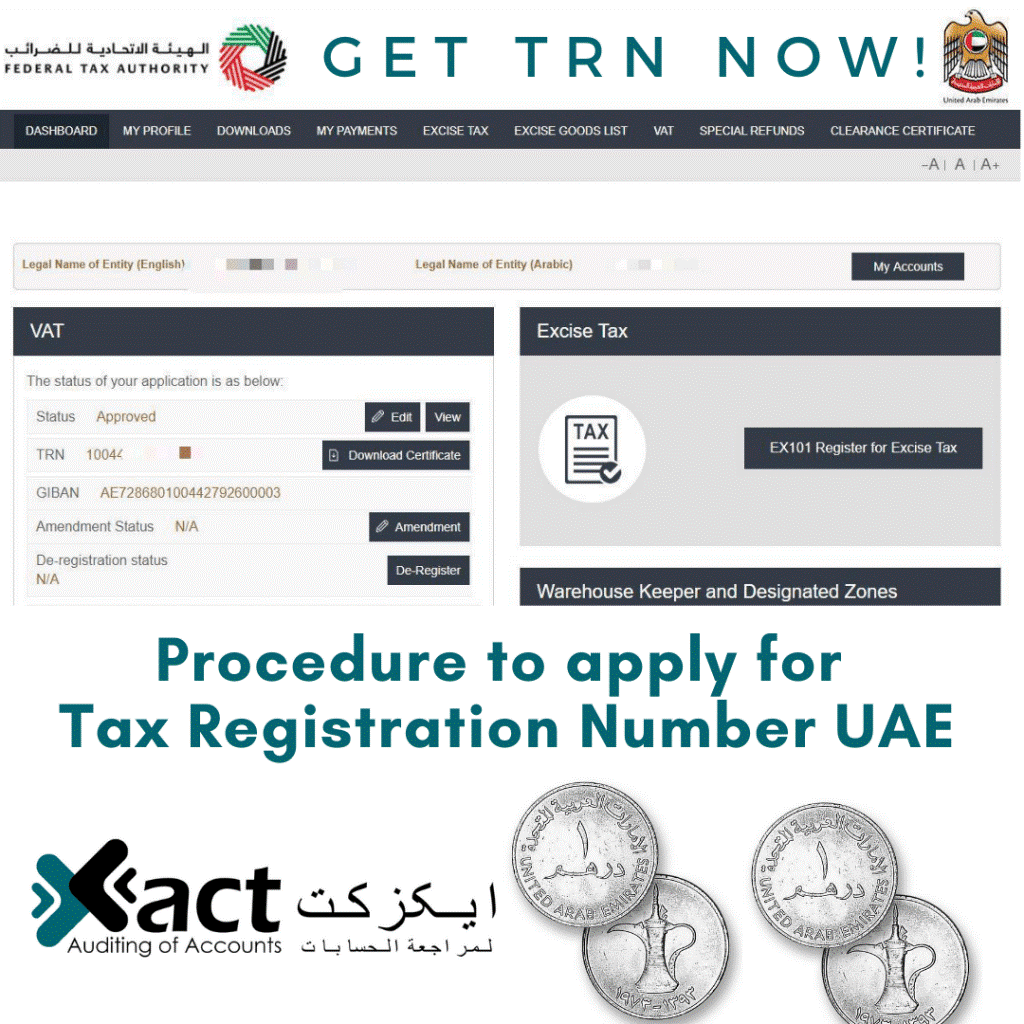

How to register for vat in europe.

How to apply for vat number. Does your business need an eu vat id number? Register for vat by post. January 10, 2024 fact checked.

How the scheme works if you choose to use the scheme you must: Immediate allocation of a new vat registration number upon. Gm professional accountants have offices located in canary.

Feb 12, 2024 • 5 min read. Print, fill in and post form vat68 to hm revenue and customs (hmrc). How to register for a vat number.

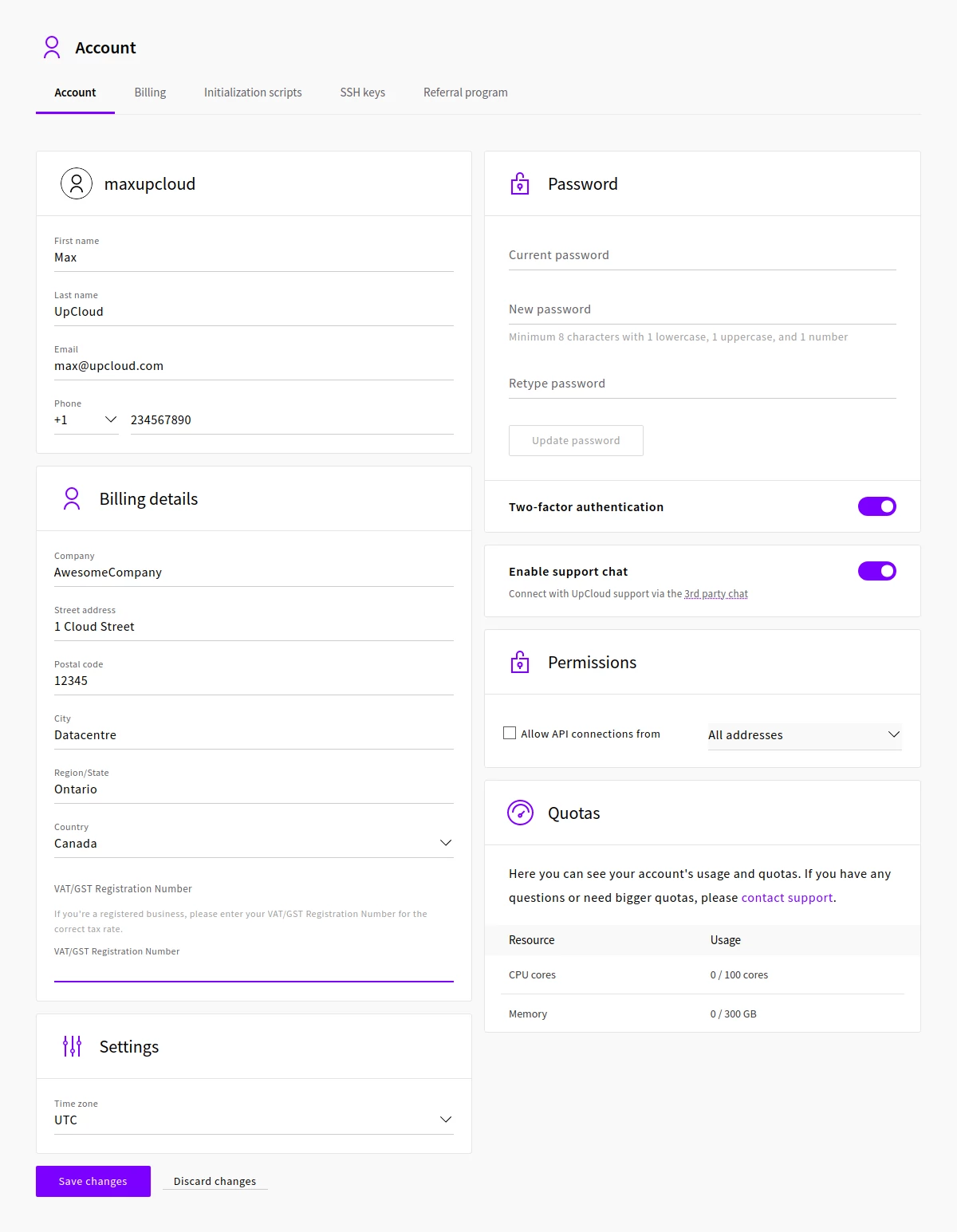

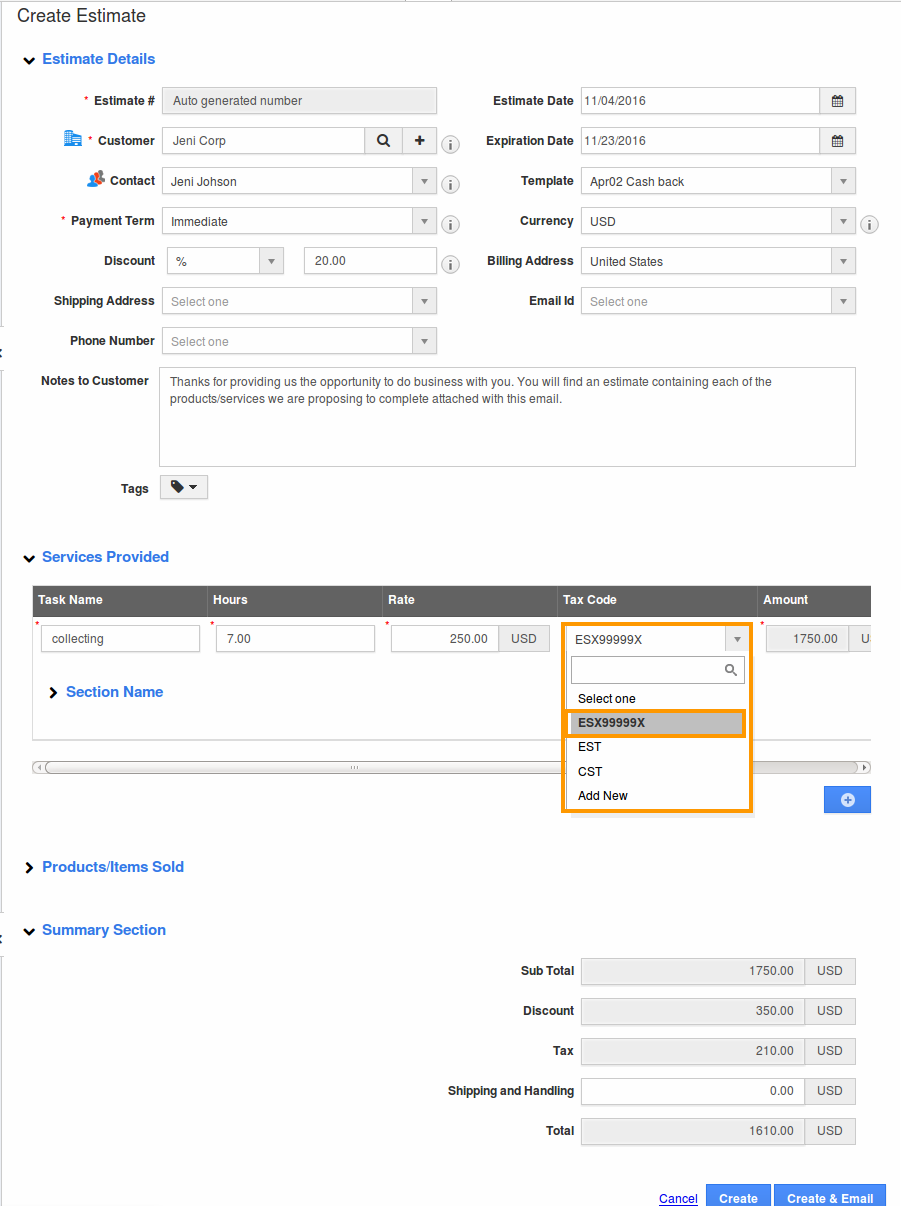

May 8, 2023 • updated on nov 22, 2023. What documents do i need to provide to. Use online services to apply for vat registration or to change your vat registration details.

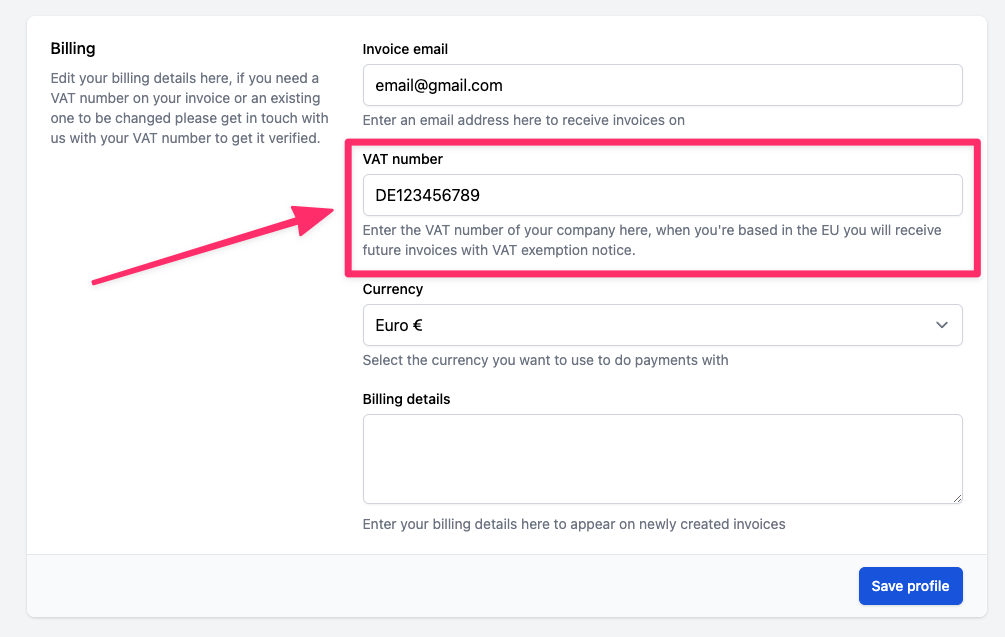

Find out when and how to use the vat1 paper form to register a new or existing business or one you're. 1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for approval;. Every vat identification number must begin with the code of the country concerned and followed by a block of digits or characters.

Registration may be backdated in certain circumstances, on agreement. What is a vat registration. Learn how to register for vat in eu countries if you sell or supply goods or services from the uk or northern ireland.

Each eu country uses its own format of vat. Check a uk vat number. Vat registration will generally take effect from the date stated on your registration form.

You must be established in. The name and address of the business the number is. Charge your customer vat at the rate applying to the goods in the eu or uk at the point of sale.

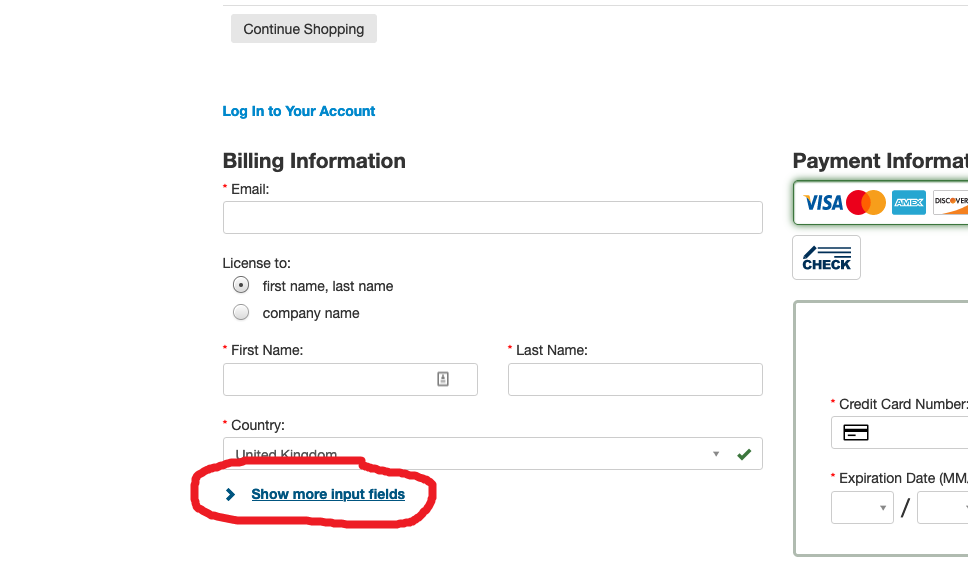

Learn when and how to register for vat in the uk, the uk's tax on goods and services. What is a vat number? There are two ways to obtain a vat number:

In order to submit an application for registration and get a vat number, you can go directly to the official website of the administration authority of the relevant country or ask for. Once your transfer is confirmed, register. Find out the requirements, steps and deadlines for different.