Cool Tips About How To Claim Work Tax Credit

In tax years 2024 and 2025, the.

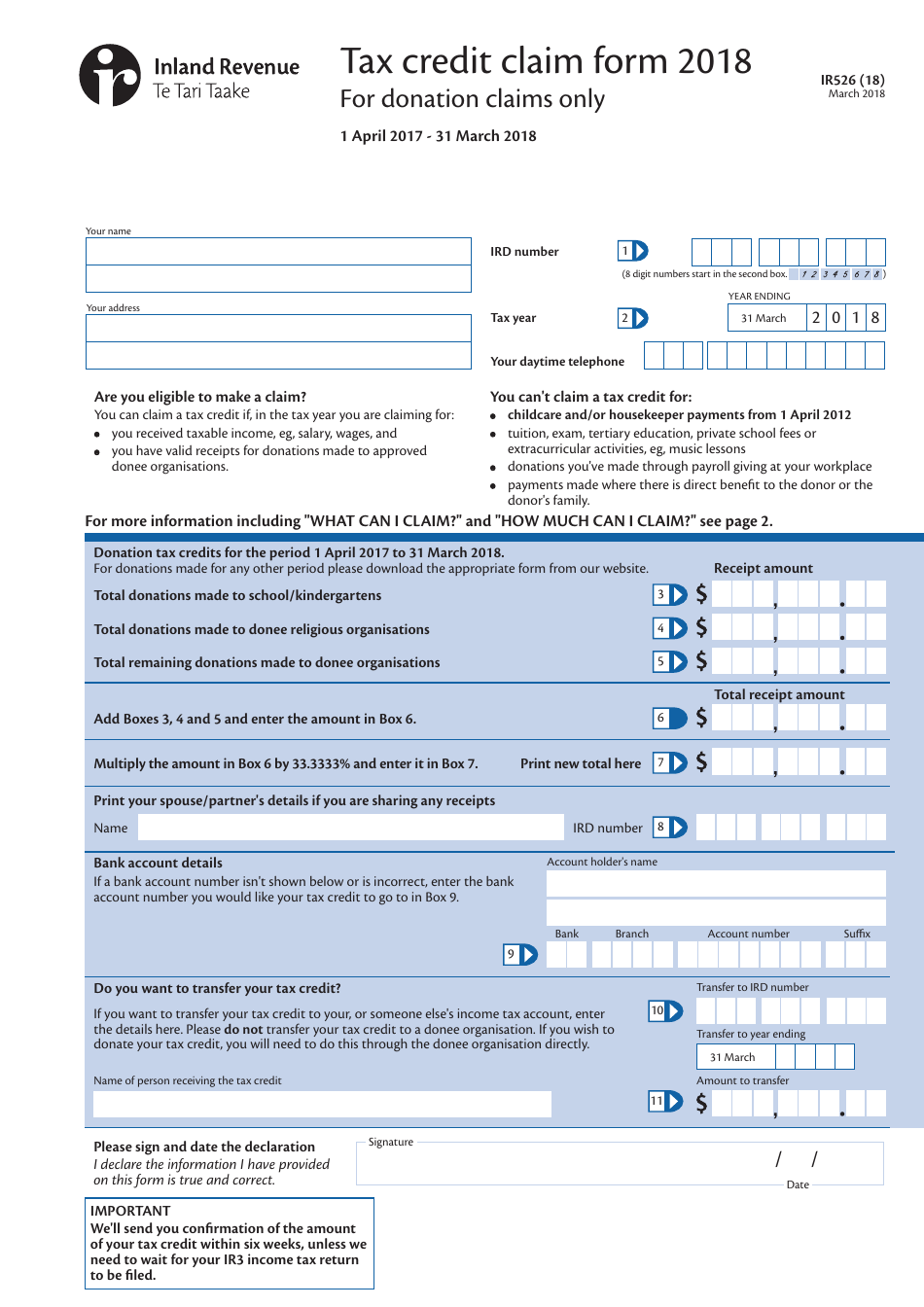

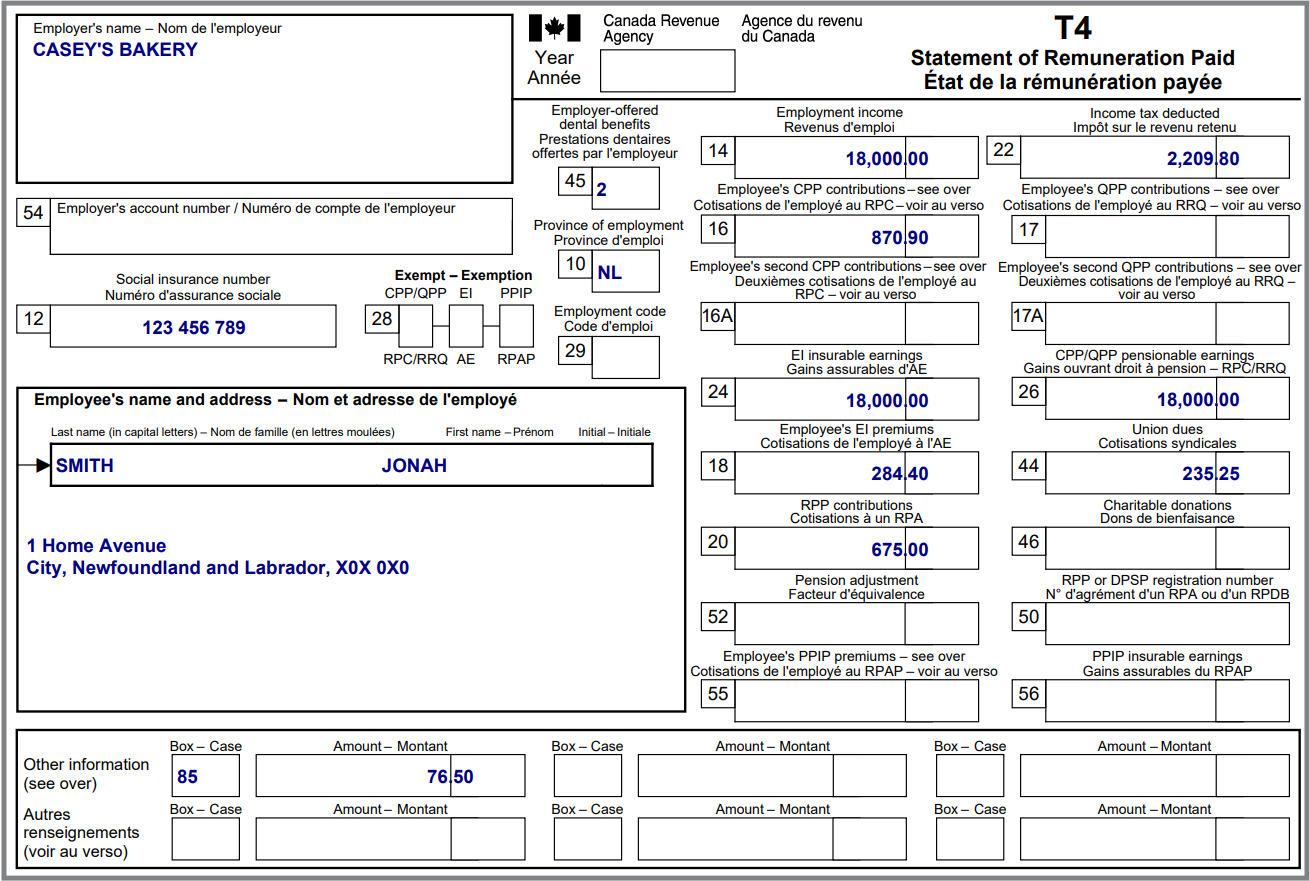

How to claim work tax credit. How to claim this credit you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. Tax credits reduce the amount of tax you pay. But it’s being replaced and most.

Before you make a claim, you. After the required certification is received, taxable employers claim the credit as a general business credit on form 3800 against their income tax by filing the following: The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

Work out your income. What is a federal tax credit? Here's how it works and what makes it different from a tax deduction.

You must have paid tax due to your employment in order to use tax credits. Earned income credit: Similarly, you could combine a heat.

How and when your benefits are paid; If you got tax credits last year and you're still eligible for them, hm revenue and customs (hmrc) will send you a renewal pack at the start of the tax year for each claim you. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number.

Only a portion is refundable this. For example, £18,000 for a couple without children or £13,100. There’s no set limit for income because it depends on your circumstances (and those of your partner).

If you do not get child tax credit Claiming the actual amount paid as a result of working from home. To get an estimate, use the the tax credits calculator on gov.uk.

Show 3 more benefits calculators, tax credits: Joint claims backdate a claim what counts as income work out your hours work out your hours put the number of hours you work in a normal week on your claim form. This credit is now known as the clean vehicle credit.

If you are already claiming tax credits and. How much is the 2024 child tax credit? Your renewal pack (if you have one) your national insurance number details about any changes to your circumstances you and your partner’s total income (6 april.

Most people cannot make new claims for tax credits. Read our information about who can claim tax credits before making a claim. Benefits benefits and work working tax credit working tax credit is designed to top up your earnings if you work and are on a low income.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Small](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg)